Do you want to know which application is the best to invest in the stock market? Whether you decide to play the market like a pro or just want to buy and hold, stock trading apps have made investing extremely popular.

Online stock brokers have seen a resurgence in recent years, with most of them now offering stock trading apps for young, technically savvy investors.

Below we take a look at the stock market apps in terms of ease of use, features, cost (or lack thereof) and trading technology to see if they can help you passively invest and build savings.

These are the best applications to invest in the stock market. A simple and affordable alternative to earn money. Increases the profitability, liquidity and flexibility of your assets . Read on to find out which one suits your needs.

1. Robin Hood

Robin Hood, launched in 2013, is a true pioneer in commission-free trading. That's right: you can trade stocks on Robin hood without paying commissions.

The platform has more than 10 million users and is valued at $7.6 billion.

It is known for making your trading process as smooth as possible with no hassle and no commissions. To demonstrate Robin hood's commitment to its app, the company has launched a stock trading app on its website.

As one of the first platforms to offer commission-free trading, Robin hood has shaken up the trading industry since its launch.

However, our hands-on test of Robin hood's stock trading app revealed that the platform offers more than just free stock trading . Available on both mobile and desktop devices, the app also allows you to trade ETFs and options for free.

Other features

Robinhood doesn't offer as many investment types as other apps on our list, but it does offer cryptocurrencies. Investors can buy and sell seven major cryptocurrencies, such as bitcoin and etherium, and follow the price of another ten.

Robinhood also allows you to invest in fractional shares, which means you can buy a part of a share. For example, with a single trade on a $325 share, Robinhood investors can purchase a fractional share for as little as $1 . However, outside of stock trading, we think Robinhood is the best investment app out there.

2. ForexTB

With this broker you can also invest in forex and cryptocurrencies, stocks and exchange-traded funds (ETFs) and contracts for difference (CFDs), as well as use the app to invest in bitcoin.

One of the benefits of this app is that it shows the risk of trading CFDs , showing the amount of a trader's losses compared to the amount of profit.

In terms of security, this company separates the merchant's money from the company's money, which is a guarantee against possible failures. ForexTB is one of the trading applications with a very simple and intuitive interface .

Other features

In addition, it makes a large number of educational materials available to its clients: video lessons, articles, webinars, e-books, and online courses are just a few examples of the tools that this broker makes available to its traders.

The options depend on your account type and range from basic to VIP. It also offers the option of a $100,000 demo account and a simulated market that is used to learn strategies, platforms and indicators.

3. Acorns

Acorn is designed for investors who don't want to be too active and who have never invested before.

In addition to the ability to build savings and use robo-advisors, Acorns offers a convenient way to put money into a gradually growing savings account.

If you want to save effortlessly, Acorns is your tool. You can easily create a user with your bank account, and Acorns tracks your purchases and puts the change in a low-risk wallet each day.

Other features

Acorns charges $1 a month for taxable investment accounts and $2 a month to add an IRA. If you have an Acorns checking account or an Acorns spending account, you'll pay $3 per month.

It is ideal for students and people who do not want to actively monitor their portfolio or take trades. It's also a good idea if you want to save money.

You need to understand that your accounts are taxable. So if you receive dividends from your portfolio, you may have to pay income taxes , which you won't if you have a tax-free investment account. But for those who just want to grow their savings, the automated approach is pretty easy.

4. Plus500

It is a trading platform regulated by the Seychelles Financial Services Regulatory Authority, and another of the best apps to trade on the stock market.

It is a CFD (Contracts for Difference) provider that currently has more than 2,000 instruments in its portfolio.

It is a good forex trading app and you can also trade stocks, commodities, cryptocurrencies, ETFs, options and indices with it. It has an intuitive and easy to use interface .

Other features

Plus500 is a well-established brokerage firm listed on the London Stock Exchange that holds its clients' funds in separate corporate accounts. This platform also offers the possibility to trade with play money through a demo account, which is a useful tool for beginners.

In addition, many of its services are free and without commissions : it is about operations such as deposits, real-time exchange rates, CFD quotes, real-time stock quotes or opening and closing trades.

5. Stash

Stash is a great trading app for beginners. There is no minimum account, but monthly commissions range from $1 to $9 depending on the package you choose.

Brandon Krieg, CEO of Stash, set out to create an educational investing app that would put financial services within everyone's reach.

We would say they have done a great job. Stash will help you understand what to invest in and how to use different investment strategies . The platform offers 60 different Exchange Traded Funds (ETFs). The service asks you to fill out a questionnaire to find out your "investor personality type."

Other features

Based on your answers, you will be classified as a conservative, moderate or aggressive investor. You can then select from a range of investments to suit your personal investment type.

Stash also allows you to create a custom portfolio of value-based investment options. For example, if renewable energies are important to you, you can invest in companies that are leaders in the development of this sector.

6. XTB

XTB's online trading platform has more than 15 years of experience and representation in more than thirteen countries and has established itself as one of the largest FX and CDF brokers in the world.

He claims that trade execution in this market is "lightning fast", with an average speed of 44 milliseconds .

It has won several awards and these brokers are supervised around the world by financial authorities such as the CNMV, FCA, KNF, BAFIN, CySEC and others.

With xStation, users have access to various financial markets around the world and can trade more than 1,500 instruments. It is a good app to invest in cryptocurrencies, forex, indices, commodities, stocks, and ETFs.

7. TD Ameritrade

TD Ameritrade strives to offer superior research tools and an easy-to-use trading platform.

Since TD Ameritrade has eliminated trading fees, it's hard to beat when it comes to stock trading apps and general brokerage features.

With tons of free educational tools, options for active and passive traders, and a $0 minimum account size, TD Ameritrade convinces investors one free trade at a time.

Other features

TD Ameritrade requires no minimum investment to get started, but is best known for being the first brokerage company to eliminate all commissions on stocks and ETFs.

Then most other brokers, including E*Trade and Fidelity, had to do the same. TD Ameritrade has made a name for itself by offering market research and analysis tools and a host of advanced investment options for active investors.

8. eToro

eToro is both an online investment platform and a stock trading app. It is a "multi-asset brokerage and social trading company".

This intuitive platform has a simple interface that allows investors - from beginners to experienced traders - to safely invest in stocks and ETFs, cryptocurrencies and commodities through CDFs.

Its main advantages over other options are the possibility to buy fractional shares, receive alerts on volatility and market events, free access to expert analysis and no limits on the size of the investment.

Other features

It also offers scenarios where shares can be purchased with a 0% commission, meaning all profits go to the investor .

Nasdaq, SP 500, UK 100, Australia, China 50 or Dow Jones are some of the indices available in this app to invest in the Argentine, Mexican, Colombian and world stock markets.

One of its main features is the CopyTrader option, which allows the investment strategies of experienced traders to be replicated, so that even beginners can benefit from this knowledge.

9. E*Trade

E*Trade makes online trading extremely easy with its easy-to-use and affordable trading platform.

It was one of the first online trading platforms on the market.

With its roots in Silicon Valley and online trading technology, the company made a name for itself by offering online trading when no other options were available. Today, E*Trade has a mobile trading app and pioneers advanced features.

After removing stocks and ETF fees, this is the easiest app to view your investments and trade stocks seamlessly on your phone.

Other features

This stock trading app is at the forefront of the fastest online trading tools and offers some educational features as well. Therefore, it is easier to use than traditional investment methods.

The truth is that E*Trade has a very easy to use mobile app that offers most of the features. Once connected to your phone, you can access all of your investments or trades in stocks , ETFs, mutual funds, and options. There are also more sophisticated trading options if you are used to placing buy and sell orders.

Most of E*Trade's tools are easy to use, and you will benefit from speedy order execution and increased accuracy. However, they are lower than the industry average due to price appreciation statistics.

10. Ninety Nine

Another of the most popular stock market apps among Latino millennials is Ninety Nine. This intermediation, which began less than a year ago, has grown significantly during the pandemic.

It provides security to its users, since it is registered with the CNMV, offers protection guarantees to private investors and has separate accounts from its clients.

Other features

With this app, anyone can invest in the stock market. All you need to sign up is an email account and a mobile phone number.

With a simple user interface, Ninety-Nine allows you to view information about different companies and markets . They work with the philosophy of "growing with the customer" and therefore provide all the information you need so that you can trade without frustration.

Choose a trading app that suits your stock trading personality

How do you like to trade? If you want to bank and invest at the same time, apps like Charles Schwab offer more advantages. Active traders, on the other hand, may be more interested in TradeStation or Interactive Brokers.

E*Trade and TD Ameritrade offer the most educational tools and have access to the most trading opportunities. Both companies also have great mobile trading apps and research tools. If you are thinking about solid investments and like to follow trends, these stock trading apps offer you a lot of money.

How much money do you need to start in stock market?

Most stock trading apps like Acorns, Stash, and Robinhood require minimal effort to get started. There is usually no minimum account to start investing.

However, the amount usually depends on the assets that you want to buy. For example, if you want to trade mutual funds, you will need a minimum of $1,000 or more . However, ETFs can be purchased for a much smaller amount.

You should also take into account the commissions, which depend on the broker you choose. While most of the top brokerage apps don't charge huge commissions for stocks and ETFs, some of them start at $5 per trade and work their way up.

Conclusion: Which stock trading app is the best?

Once you decide which style of investment you want to emulate, there are plenty of stock trading apps on the market.

Whether you want to take advantage of all available options or invest in stocks on your own, you need to consider costs, fees, security, mobile experience and customer support before opening a mobile brokerage account.

For those who want a wide range of options, we like Acorns, Robinhood, and Stash for their ease of use, simplicity, and low to no fees. TD Ameritrade and E*Trade are also good options as they offer a wide range of investment options.

The above content published at Collaborative Research Group is for informational purposes only and has been developed by referring to reliable sources and recommendations from experts. We do not have any contact with official entities nor do we intend to replace the information that they emit.

Katheryn is a corporate attorney and finance specialist, conducting research daily to get you closer to financial security and freedom (even if you're just getting started). Her +600 articles published in Collaborative Research Group have already helped thousands of readers on the internet. .

Leave a reply

Your email address will not be published. Required fields are marked *Recent post

Does Instagram Notify When You Screenshot a Post of Someone?

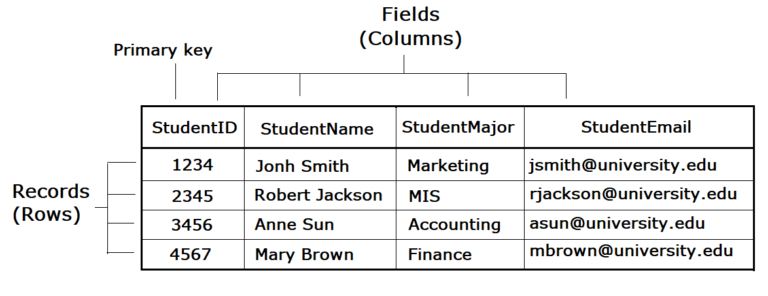

Difference Between Field And Record In Database

The difference between rows and columns in Excel